There's an oil super cycle, you say? A 3 part story

Sustainability of bullish crude cycle will be tested in 22'

Part 1: Domestic Demand

Energy Domination

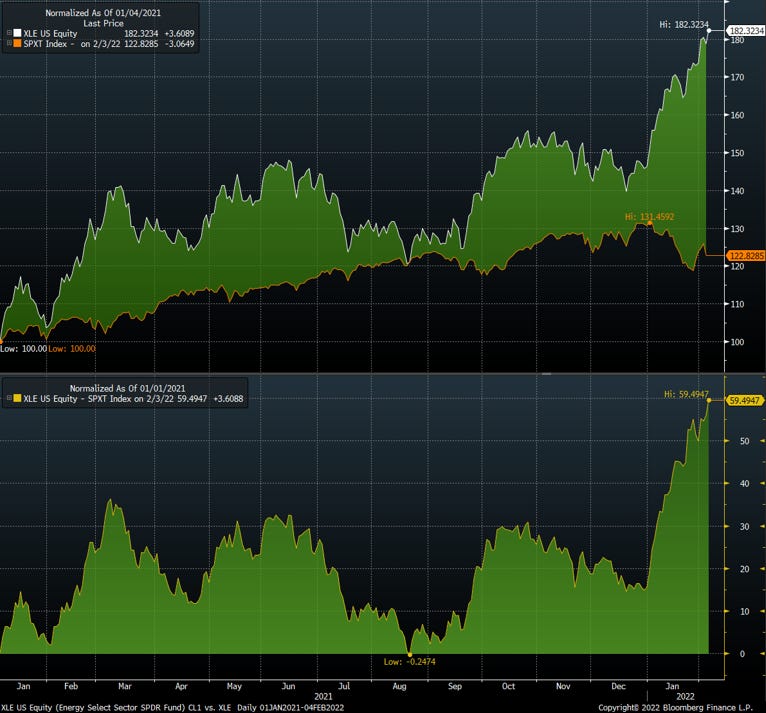

Energy sector outperformance dominated global equity markets last year, but if you are reading this you probably already knew that.

Naysayers will point out energy has been a laggard if you go back across nearly any duration, and they are not entirely wrong. Energy outperformance peaked in 2008, as unconventional shale development was in it’s infancy. That is not a coincidence, but that digression is for another time.

In a “what have you done for me lately” world, investors are seeing portfolios ravaged by tech implosions and energy weighted indices rip. Comparisons to the 99’-01’ tech bubble are becoming more frequent, and people are saying we will see the growth to value ratio revert to the mean (that’s a long way down!!). This is hard to ignore when market bellwethers like Meta (fka Facebook) are down 25% after missing earnings, and reporting slowing growth.

But what does this mean for energy equities and commodities? Are we actually in a super cycle, or will we see dreams of sustained $80-100+ oil dashed as the cycle continues? The TL;DR (too long; didn’t read) version: price levels that induce demand destruction are coming if supply doesn’t accelerate meaningfully in 1H22’. My base case is supply won’t be able to meet demand growth in 1H22’. 2H22’, now that is a very different story.

Balancing act first

The last 18 months have seen a near record drawdown in global inventories (on TTM basis). Total OECD crude stocks effectively erased the builds from the 14’/15’ price war between US shale and OPEC. The pace of storage declines were fundamentally supportive of prices accelerating. Crude prices reached a cycle high on 2/4/22 (and were still climbing at the time of writing).

Going forward, forecasting agencies like the IEA and EIA are estimated storage to re-accelerate during 22’ driven by a supply surplus. If their forecasts are right, that would mean crude is likely tapped out soon. But are they right?

The next three posts will focus on 5 key areas, how they impact the supply/demand balances, and what they ultimately mean in terms of crude’s price path over the next 6-12 months.

Demand decelerates - US and Global crude demand continue to grow, but at a slower pace. Absolute growth is a key point here.

Running low on spare production - OPEC+ spare capacity is nearing normal levels. Further production expansion (beyond spare capacity) will require capex acceleration, and likely delayed until 2H22’ at the earliest.

US supply growth delayed - L48 production acceleration is likely to be limited in 1H22’ due to transitory supply chain issues that likely recede going into 2Q22’. Easing supply chains in 2H22’ will provide a path for US production to grow.

Brrr’ machine turns off - Federal Reserve signaled an end to easing with rate hikes coming in March 22’ and balance sheet growth slowing.

Price spiking - storage deceleration from 1H22’ undersupply drives continued deceleration in storage, and likely results in a price spike which nears demand destruction levels.

Demand growth

As each Covid wave passes, the severity and resulting hit to demand is lessened. Asset markets have started to look through this, as seen in the breakdown of the correlation between crude oil (CL1) and daily Covid cases.

The reduced severity of each wave is allowing mobility to recover faster. Retail/recreation mobility is shown below, and is likely to recover to pre-pandemic levels in the spring.

Domestic Big 3: Gasoline, Distillates/Diesel and Jet Fuel

Working our way from the smallest demand component (jet fuel) to the biggest (gasoline).

Starting with Jet Fuel

Jet fuel was the hardest hit refined product in the downturn as flights nearly went to 0. While that is the bad news, the good news is domestic air travel returned to near pre-pandemic levels in 3Q21’ and is likely to exceed 21’ levels in 2022.

Jet fuel didn’t return to pre-pandemic levels primarily due to international flights, which are down ~70% (latest data from DOT as of 3Q21’). The historical relationship between domestic and international air travel is fairly strong over the last 21 years. With the primary causal factor fading (ie. Covid severity), that headwind is now turning into a tailwind as international borders become easier to traverse.

Now distillates

It is no secret e-commerce was a massive hit during the pandemic. However, the deviation from trend was short lived and we have reverted to the long-term trend. There is a question to be asked if we will see a drop below the trend, but for now I will assume we resume trend growth (not a retail analyst).

This shift to online shopping drove a swift rebound in truck loadings. All-time high truck loadings helped drive distillate demand to near all-time highs in late 21’.

Demand outpaced supply from refiners and drove a massive decline in inventories.

With a slower demand growth rate (limited tailwinds on the margin), storage is likely to re-accelerate. My base case forecast assumes implied distillate demand averages ~4.1mmbbl/d in 2022 (~3% growth vs. 2019).

Lastly, our sweet sweet gasoline

It’s the thing that nearly everybody uses and the source of much pain for consumers when it goes to the moon. The pandemic drove a phase transition in the way people think about mobility. Less mass transit, and more personal vehicles! After the early lockdowns were lifted, cars started selling at near record pace. In early 2021, auto sales reached a 15 year high…before falling off a cliff due to inventory shortages.

At the same time sales were surging, supply chain constraints in steel and semiconductors were also worsening. That combination drove new inventories (as measured by days to turn) to record lows (~26 days to turn as of December 21’ - per Bloomberg).

With new inventories depleted, used cars started selling like hot cakes. In 3Q21’ used car sales hit a record of ~955,000 units - per Bloomberg. Used inventories across dealerships have also fallen to near record lows. Those two factors drove used car pricing sky high. For people watching the auto supply chain, this figure is critical. Falling used prices likely indicate easing supply chains for the auto industry.

Why is this tangent important to gasoline demand? Well, in 1H22’, it is unlikely inventories will accelerate due to the nagging supply chain issues. That means it is difficult for sales to accelerate (purely due to supply chain issues, not taking into account consumer dynamics which also have headwinds coming). As auto supply chain tightness eases, the inventory problem is likely to recede (likely a 23’ event).

I walked through the path of car sales to gasoline demand in a previous post, but simply more car sales = more gasoline demand.

Even with a slower growth rate in vehicle miles traveled (“VMT”), gasoline demand has a path back to all-time highs as we approach summer (as seen in July 21’). Again, the key here is absolute growth is still likely, even if at a slower pace. My base case has implied gasoline demand growing to ~10mmbbl/d by summer 22’, and averaging ~9.2mmbbl/d throughout 2022.

Aggregating the various components of domestic demand, I generate a base case implied crude demand domestically of ~16.3mmbbl/d. It is likely we see peak demand during summer of close to ~17.1mmbbl/d, which is ~3.6% lower than pre-pandemic levels. The export case, which is impacted by international factors, will be discussed in a subsequent post.

There is a TON of detail behind the above, and I condensed down the domestic components to fit in this format. At the end of this series, I will make my 22’ crude outlook available for everyone to download (~110 page PDF deck). This will be done through the Substack platform.

The next post will analyze the likelihood of a timely supply response meeting continued demand growth in 22’. Hint: transitory supply chain issues will make it difficult for supply to meet 1H22’ demand growth. Then fun part comes in 2H22’.

If you found this analysis helpful, please feel free to forward to your colleagues and anyone interested in the energy markets!

Disclaimer: This is not investment advice. All of the views are my own, and not representative of Donovan Ventures, LLC or Energy Founders Fund, L.P.

Hi Rob, thank you very much for this post. Any idea on where I can find the crude report pdf to download ?